In any normal year, the tax season is that bit between December 31st, the end of the financial year, and April 15, the Internal Revenue Service’s deadline for tax returns. It’s a few weeks of collecting and collating your information and making sure everything’s in order.

2020’s tax season is looking a little different. On March 23 2020, the Government passed the CARES Act to help the country while it fought off COVID-19. That Act included the extension of deadlines for filing tax returns for three months, until July 15.

So if you’re among those who haven’t yet filed, it’s a good time to be getting on with it. Here’s what you need to know about the changes made to taxes in 2020, and how to prepare your tax return.

The 2020 Tax Season: What’s New?

The current Administration knows that this tax season is key to their next election campaign and some key changes have been made, potentially to sway the voters.

The Affordable Care Act

One of the big changes involves the Affordable Care Act, as it was changed by the 2017 Tax Cuts and Jobs Act. If you were required to have health insurance under the Affordable Care Act but you did not, a tax penalty was applied. In the 2020 tax season, that no longer applies. Also, the threshold for when taxpayers can take a deduction for expenses related to medical or dental bills has returned to its previous rate of 10%.

Divorce and Alimony

Previously, alimony payments were tax deductible. That’s no longer the case, and alimony payments received will not count as taxable income. It gets more complicated though. Tax changes will affect IRAs as when alimony payments are made from IRAs, they won’t be taxed on withdrawal but the receiving spouse will pay tax on them.

Workplace Retirement Plans

Limits for workplace retirement plan contributions have increased for the 2019 tax year. They now stand at $19,000, or $25,000 for those above the age of 50. Contributions to Health Savings Accounts have increased to $3,500 for individuals and $7,000 for family accounts. Be sure to be familiar with the rules on expenditure from Health Savings Accounts.

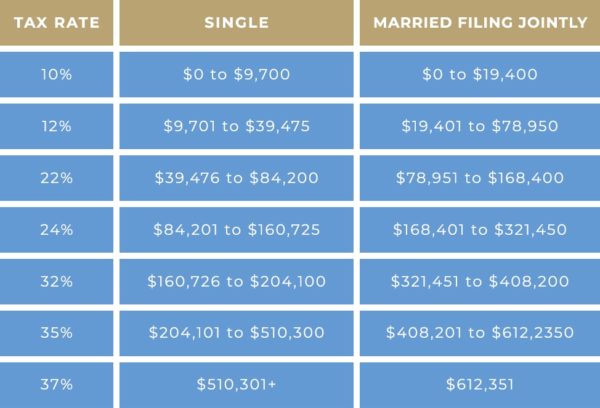

2020 Tax Brackets

Income requirements for the tax brackets have been raised, meaning that you might fall into a lower tax bracket than in previous years. These new brackets will expire in 2025 if they’re not made permanent before that. Use this table to see if your tax bracket has changed for 2020.

Personal exemptions are still repealed as they were in the previous tax year.

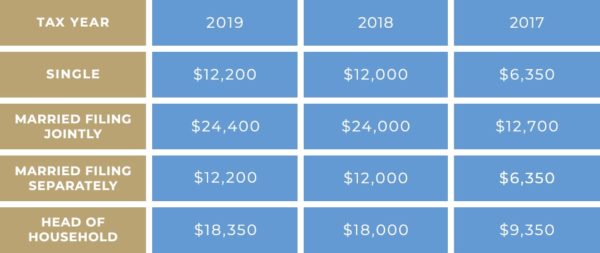

Standard Deductions

Standard deductions have increased once again for the 2020 tax seasons, providing a benefit for many over itemizing. Previously, taxpayers could claim exemptions for themselves, spouses and dependents. Since this was repealed, the higher deduction fills that gap.

Itemizing

The way itemized deductions can be claimed on Schedule A were changed for 2020 in the following ways:

- Itemized deductions are not limited if your AGI exceeds a certain amount

- Total deductions from state and local income as well as property taxes are limited to $10,000 or $5,000 if you’re married, filing separately

- Job-related and other miscellaneous expenses can no longer be deducted but certain other expenses, including gambling losses, can

- The cash charity contribution limit is now 60% of your AGI

- Deductions for the interest on mortgage debt are limited to up to $750,000 of the home’s loan amount. This doesn’t apply if you contracted to close on your new home between December 16 2018 and April 1 2019, inclusive.

Capital Losses

If you’re an investor in the financial markets, you should consider capital losses as part of your preparation during any year and not just the 2020 tax season. If your capital losses were more than your capital gains, you can claim them as deductions.

Covid-19: Changes to Itemizing

However, the Covid-19 pandemic has changed not only deadlines but also changed the rules to itemizing even further. So if you’re yet to file, these changes might make a difference to you.

Under the CARES Act, non-itemized charitable deductions are allowed of up to $300, and there’s now no annual limit for itemizers who can now deduct up to 100% of their AGI for 2020.

Don’t forget to consult a professional if the standard and itemized deductions are causing you any worry.

The 2020 Tax Season: How to Prepare

If you’ve taken advantage of the extension to this year’s tax filing deadlines, you need to start preparing now. If you come up against any challenges or obstacles, you’ll need that time to iron those out. If any of your personal circumstances have changed significantly since you last filed, getting on top of this sooner rather than later will help.

If you’re employed, start with conducting a paycheck checkup. You can use the online calculator from the IRS to work out the correct withholding. That will make sure there’s no nasty surprises later on down the line. Once the calculator has done its math, you’ll know whether you’re due a refund or whether you owe taxes.

To use the calculator, you’ll need a recent pay stub, a recent income tax return and a completed Form 1040. The calculator can help with more complicated scenarios such as if you:

- Have a two-income household

- Have two or more jobs

- Work for only a few months of the year

- Can claim child tax and other credits

- Have dependents over the age of 16

- Itemized your deductions last year

- Are a high earner

- Received a large refund or paid a large tax bill for 2018

Remember that the calculator is no substitute for professional advice. Do get in touch if you think it’s wrong or are considering changing your tax strategy based on its results.

The 2020 tax season was already subject to several significant changes. The global coronavirus pandemic and the passing of the CARES Act only made it more complicated. If you’re yet to file and you feel like you need some extra professional help, give our office a call. We’ll be happy to help.